Technical Analysis Post

Understanding the Current Market Sentiment and Impact of Inflation on Markets

Federal Reserve Chair Jerome Powell recently emphasized the ongoing concern about the lack of significant progress in inflation. There are still speculations in the market about a possible rate cut, not at next week’s May 1 meeting but at the upcoming June 12 meeting. The FedWatch tool provided by CME Group indicates a 11.2% probability of a 0.25% rate cut, up from 9.3% ahead of yesterday’s GDP figures.

Federal Reserve Chair Jerome Powell recently emphasized the ongoing concern about the lack of significant progress in inflation. There are still speculations in the market about a possible rate cut, not at next week’s May 1 meeting but at the upcoming June 12 meeting. The FedWatch tool provided by CME Group indicates a 11.2% probability of a 0.25% rate cut, up from 9.3% ahead of yesterday’s GDP figures.

Factors Influencing Market Dynamics

Core Inflation Data

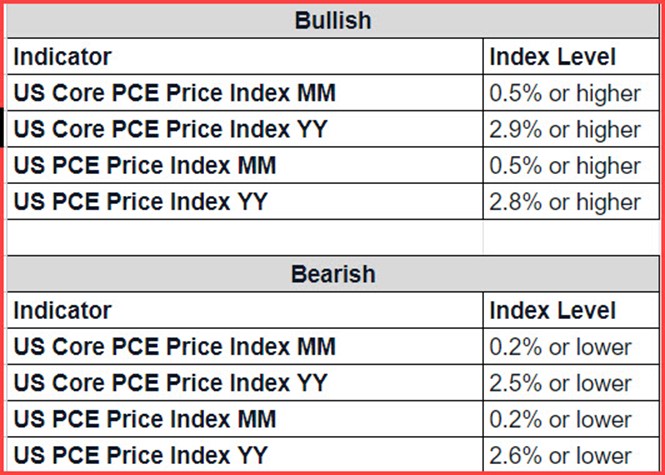

The core inflation data in the Personal Consumption Expenditures (PCE) report has a big impact on the market. It will be released today. Higher-than-anticipated PCE figures, such as a 0.4% increase from the previous month, might prevent the Fed from cutting interest rates as expected. The US Dollar (USD) could strengthen and the Dollar Index (DXY) could surpass 106. This would cause the EUR/USD exchange rate to decrease from its current level above 1.07. Notably, a bullish USD could further propel the USD/JPY pair Moving towards level 156 could increase the risks of intervention.

US Core PCE Prices Advance for Q1 2024

Analysts are closely monitoring the US Core PCE Prices Advance data for the first quarter of 2024. With anticipations running high following recent Gross Domestic Product (GDP) and PCE deflator releases. Core PCE Prices Advance at 3.55%, would signal a PCE print of 0.4%. Should the actual reading surpass this threshold to reach 3.7%, it could herald a significant upside surprise. Despite a lower-than-expected GDP growth rate of 1.6%, compared to the projected 2.4%, the focus remains on heightened inflation levels. This inclination towards inflation could bolster the USD, trigger supply in US bonds, and lead to stock market corrections.

Market Expectations and Potential Outcomes

Possible Scenarios

- Higher-than-Expected Inflation Indicators: If inflation indicators for March 2024, like the US Core PCE Price Index, exceed expectations, the USD is likely to strengthen. This could entail heightened supply pressure on EUR/USD facing selling headwinds.

- Unexpected Drop in Inflation: A sudden decrease in inflation could weaken the USD. Consequently, EUR/USD may encounter demand.

Source:

Source:

https://www.fxstreet.com/analysis/eur-usd-forecast-the-next-target-emerges-at-the-200-day-sma-202404251706

ForexSource