Weekly Outlook

U.S. economic growth and resilience, Lower inflation projections, Fed: Cuts yes but no rash, Canada evades recession, Core PCE inflation lower than expected, NFP ahead!

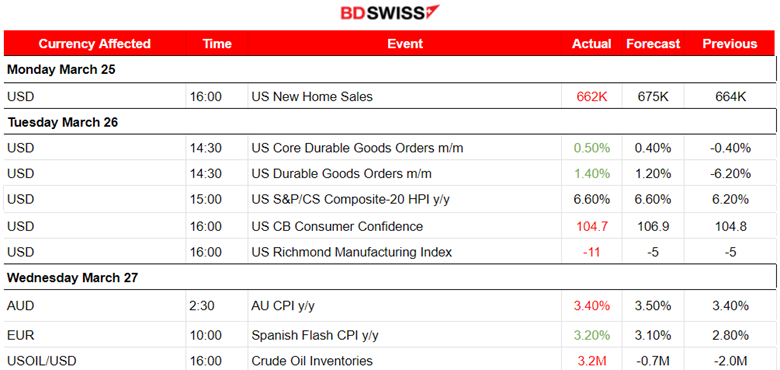

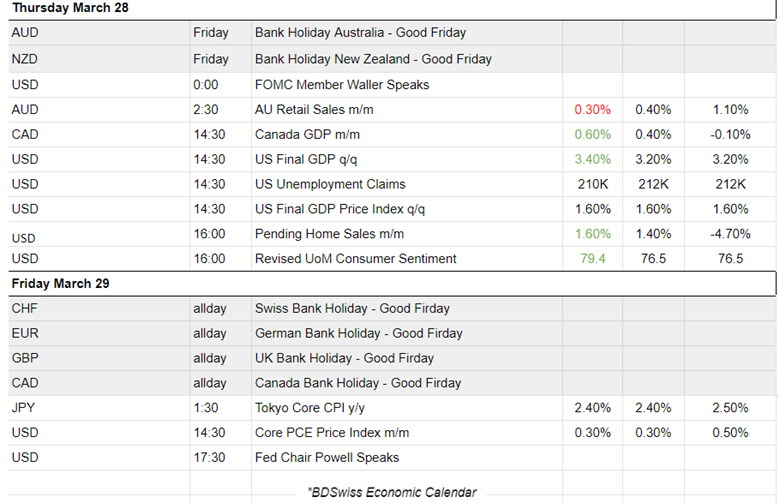

PREVIOUS WEEK’S EVENTS (Week 25 – 29.04.2024)

Announcements:

U.S. Economy

U.S. manufactured goods orders increased more than expected in February. The rebound in durable goods orders recouped some of January’s sharp losses. Orders for durable goods rose 1.4% last month, the Commerce Department’s Census Bureau said. Orders advanced 1.8% on a year-on-year basis in February.

Manufacturing activity appears to be picking up again and recovery of the sector seems to be on.

Consumers are noticing the economy’s resilience. The conference board said its consumer confidence index was little changed at 104.7 in March. In addition, consumers expressed more concern about the U.S. political environment compared to prior months.

The Federal Reserve Governor Christopher Waller said there is no rush to lower interest rates, emphasising that recent economic data warrants delaying or reducing the number of cuts seen this year.

Waller described recent inflation figures as “disappointing” and said he wants to see “at least a couple months of better inflation data” before cutting. The Fed has room to wait to gain confidence that inflation is on a sustained path toward the 2% target since the economy is strong.

Fed officials are debating when and to what extent to lower borrowing costs this year. Chair Jerome Powell has called the timing of such a decision “highly consequential” and emphasised the need for patience.

The economy experiences resilient growth, and Fed policymakers significantly boosted their estimate for gross domestic product this year to 2.1%, up from 1.4% in December.

Canada Economy

Canada’s gross domestic product (GDP) strongly rebounded in January exceeding expectations and February’s preliminary estimates point to another expansion, tempering pressure on the Bank of Canada (BoC) for an early rate cut.

The economy grew by 0.6% in January, its fastest growth rate in a year. February’s GDP is also likely to have grown by 0.4%.

The central bank has maintained its key policy rate at a 22-year high of 5% since July, but BoC’s Governing Council in March agreed that conditions for rate cuts should materialise this year if the economy evolves in line with its projections.

Canada’s economy has evaded recession in the face of high interest rates which the BoC has maintained at a 22-year high of 5% for the last eight months in efforts to rein in inflation.

______________________________________________________________________

Inflation

United States

The personal consumption expenditures (PCE) price index figure, showed that U.S. prices moderated in February, with the cost of services outside housing and energy slowing significantly, keeping a June interest rate cut from the Federal Reserve on the table. The price index rose 0.3% last month. Core services inflation is slowing and it is expected to continue throughout the year. In the 12 months through February, PCE inflation advanced 2.5% after increasing 2.4% in January.

Though price pressures are subsiding, the pace has slowed from the first half of last year, and inflation remains above the U.S. central bank’s 2% target. Fed Chair Jerome Powell said that February’s inflation data was “more along the lines of what we want to see.”

Policymakers anticipate three rate cuts this year. Financial markets expect the first rate reduction in June. Most U.S. financial markets were closed for the Good Friday holiday, with the exception of the foreign exchange market.

______________________________________________________________________

Sources:

https://www.reuters.com/markets/us/us-durable-goods-orders-rebound-february-2024-03-26/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 25 – 29.04.2024)

Server Time / Timezone EEST (UTC+02:00)

_____________________________________________________________________________________________

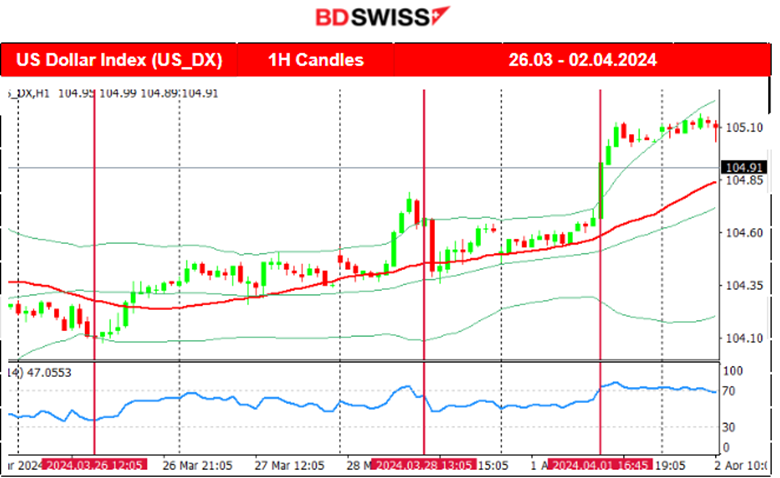

FOREX MARKETS MONITOR

Dollar Index (US_DX)

The recent news for the U.S. Economy has been favourable for the USD. The dollar index has been moving steadily to the upside. Higher numbers for Durable Goods orders, Higher GDP figures and possible delays in cuts have been raising the USD’s strength. The PCE inflation figure was reported lower on the 28th of March and the market reacted with a sudden USD depreciation causing a drop in the dollar index. However, it recovered soon and continued with the upward trend. The manufacturing sector is expanding and expectations of a growing economy are causing further dollar strengthening.

EURUSD

EURUSD

The pair moved downwards overall, the opposite path of the dollar index indicating how the USD mainly drives the pair. EURUSD remained below the 30-period MA on its way down as the USD was appreciating. The EUR is not currently much affected by the news, however, the Central Banks could proceed to further comments regarding interest rate cuts soon. The Eurozone has suffered much lately due to the tightening measures, especially in Germany. Inflation in the Eurozone is on the desirable downward path and since the economy is on critical levels a change in policy is quite likely to take place soon.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD

Since the 22nd of March, Bitcoin experienced a good comeback with the price moving upwards crossing the 30-period MA on its way up and showing upward momentum since the fall from the 74K USD peak. The 68K USD level resistance was breached on the 25th of March and the price moved higher even beyond 70K USD. The 30-period MA turned sideways as the price slowed down.

Last week a steady upward movement took place forming a wedge until the 31st of March. On the 1st of April, the price broke the wedge to the downside and dropped heavily back to support near 69K USD. That support was broken twice as Bitcoin eventually on the 2nd of April saw heavy drops. Around the same time as the drawdown, Bitcoin exchange-traded funds (ETFs) posted a net outflow of $86 million, breaking a four-day positive inflow streak, per FarSide data.

Source: https://cointelegraph.com/news/bitcoin-price-flash-crash-leverage-positions-liquidated

_____________________________________________________________________________________________

_____________________________________________________________________________________________

NEXT WEEK’S EVENTS (01 – 05.04.2024)

Coming up:

The monthly employment data for Canada and the U.S., NFP report this Friday!

Fed’s statements and views!

Inflation reports for the eurozone and Switzerland.

Manufacturing and services sector PMI releases.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

On the 27th of March, the price reversed, crossing the 30-period MA on its way up and settled currently near 81.50 USD/b. On the 28th of March, we have a wedge breakout to the upside that leads the price back to 83 USD/b. The 82 USD/b was an important resistance and upon breakout, it led to the price jump. The market closed on the 29th of March. On the 1st of April, after the news regarding the expansion of the U.S. manufacturing sector Crude oil actually jumped higher and remained on the upside. Today it’s aggressively moving on this uptrend confirming an upside strong momentum.

The latest news shows that production cuts indeed take place. Reuters Survey Shows OPEC Output Reduced in March:

Gold (XAUUSD)

Gold (XAUUSD)

On the 27th of March Gold saw a rise again and tested the resistance at 2,200 USD/oz again. As mentioned in our previous analysis, Gold continued with the upside on the 28th of March. It experienced a great upward movement as it broke that resistance. The 2,200 USD/oz level was quite important and part of a triangle formation. Its resistance breakout led to a jump over 2,230 USD/oz. The market closed on the 29th of March. On the 1st of April the price lowered and despite the manufacturing PMI favourable for the USD release that caused the price to drop heavily, Gold could not remain on the downside. An uptrend formed and continues to be resilient. _____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500)

Price Movement

S&P500 jumped to near 5,270 USD on the 27th of March. This move broke the channel and it crossed the 30-period MA on its way up. The market was closed on the 29th of March. On the 1st of April, the market opened with a gap upwards. Correction followed with a heavy drop until the support near 5,234 USD. Retracement followed with the price approaching and staying close to the 30-period MA. Currently, there are no apparent signals on where the market is headed. However, the RSI is showing higher lows.

______________________________________________________________