Weekly Outlook

BOJ rate hike, SNB rate cut, RBA and BOE rates unchanged, FOMC market volatility, Powell: Rates unchanged but Fed’s cuts on track, Key U.S. inflation projected to drop, PCE price index figure ahead this week

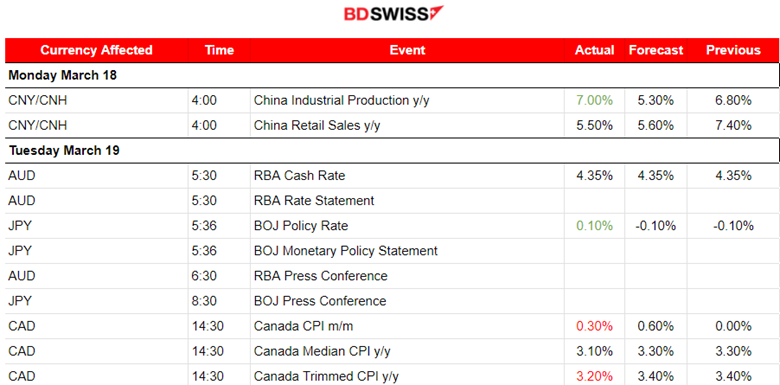

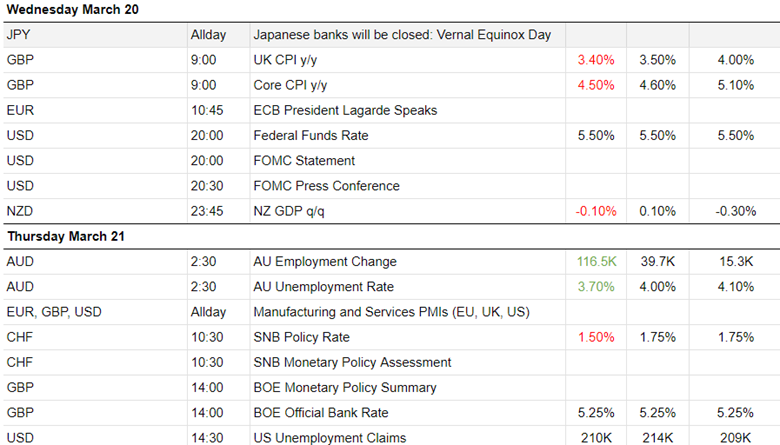

PREVIOUS WEEK’S EVENTS (Week 18 – 22.03.2024)

Announcements:

U.S. Economy

The Federal Reserve Chair Jerome Powell said last week during his speech that recent high inflation readings had not changed much the narrative of easing and the central bank stayed on track for three interest rate cuts this year.

The Fed left interest rates unchanged and released new quarterly economic projections that showed officials now expect the economy to grow 2.1% this year.

At the same time, the unemployment rate is only expected to hit 4% by the end of 2024, barely changed from the current 3.9% level, while a key measure of inflation is projected to keep falling, though at a somewhat slower pace, to end the year at 2.6%.

The Fed officials held onto their outlook for three cuts in borrowing costs this year. Powell said the timing of those reductions still depends on officials becoming more certain that inflation will continue to decline towards the Fed’s 2% target even as the economy continues to outperform expectations.

Starting in March 2022 the Fed raised interest rates rapidly to fight decades-high inflation, bringing its short-term benchmark rate to the 5.25%-5.5% range where it has kept it since last July.

Last Week’s Friday’s panel made clear that for some Americans, that time cannot come soon enough. Rising borrowing costs coupled with higher energy and transportation prices as well as rising wages are squeezing profits for small and medium-sized manufacturers, said Cara Walton, director at Southfield. Other panellists gave accounts of the impact of continuing pressures from higher prices, even as the rate of increase – inflation – has slowed under pressure of the Fed’s interest-rate hikes.

______________________________________________________________________

Inflation

Canada

CPI inflation was reported lower than expected for Canada. CAD depreciated against other currencies, USDCAD jumped and retracement was roughly instant. Year-to-year calculation actually fell to 2.8%, giving a good explanation of why the market reacted with an instant CAD weakening.

______________________________________________________________________

Interest Rates

BOJ

The Bank of Japan (BOJ) ended eight years of negative interest rates making a historic shift away from its focus on reflating growth with decades of massive monetary stimulus.

This is Japan’s first interest rate hike in 17 years. The shift makes Japan the last central bank to exit negative rates. Fragile economic recovery forces the central bank to go slow on further rises in borrowing costs, analysts say.

The central bank also abandoned yield curve control (YCC), a policy in place since 2016 that capped long-term interest rates around zero, and discontinued purchases of risky assets.

“If trend inflation heightens a bit more, that may lead to an increase in short-term rates,” Governor Ueda said, without elaborating on the likely pace and timing of further rate hikes.

RBA

Australia’s central bank held interest rates steady signalling greater confidence that inflation is moving back to its target as the economy slows.

The Reserve Bank of Australia (RBA) kept rates at a 12-year high of 4.35% for a third straight meeting and said it was not ruling anything in or out on policy.

“The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out,” said the RBA Board in a statement.

SNB

The Swiss National Bank surprised the markets with an interest rate cut by 25 basis points to 1.50%. The SNB’s loosening of monetary policy suggests inflation is under control. The rate cut was the Swiss Central Bank’s first in nine years.

After the Federal Reserve projected a less restrictive policy stance than expected on Wednesday, risk assets worldwide soared, as did the outlook for investment flows to the U.S.

“The flow of currency into the United States remains essentially unstoppable at this point given the optimism around where the U.S. economy is headed,” said Karl Schamotta, chief market strategist at Corpay in Toronto.

The differential in U.S. interest rates and those of other major economies also helped the dollar.

BOE

The BoE’s rate-setters voted 8-1 to keep borrowing costs at their 16-year high of 5.25% on Thursday, as the two officials who had previously called for higher rates changed their stance.

Britain’s economy is “moving in the right direction” for the Bank of England to start cutting interest rates, Governor Andrew Bailey said.

Recent communications suggest the MPC is gaining confidence that inflation will fall sustainably back to the 2.0% target.

______________________________________________________________________

Sources:

https://www.reuters.com/markets/rates-bonds/view-bank-england-interest-rate-decision-2024-03-21/

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (Week 18 – 22.03.2024)

Server Time / Timezone EEST (UTC+02:00)

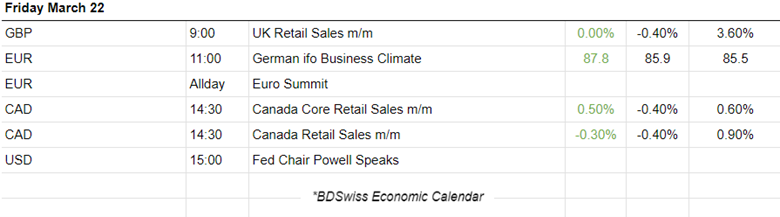

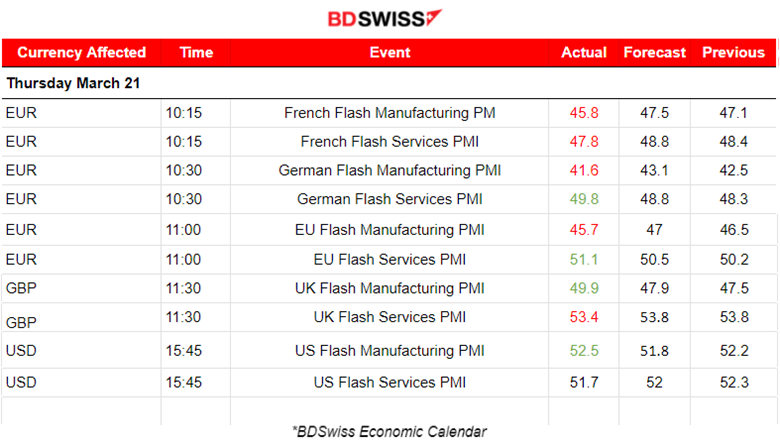

PMIs:

Eurozone:

In France: Both PMIs fell beyond expectations. The French private sector business activity seems to fall at a slightly faster pace according to the report, remaining in contraction territory at the end of the first quarter. The faster fall in output came amid a quicker deterioration in demand for French goods and services, with this also contributing to a renewed decrease in employment.

The PMI report in Germany shows that the economy eased slightly in March. Business activity in the country’s service sector came close to stabilising. Business confidence towards future activity continued to improve. The manufacturing PMI was reported at 41.6 points. The Services PMI improved to 49.8 points.

In the Eurozone, the economy is close to stabilising in Marcha amid price pressures easing. A modest recovery of service sector output gained momentum, accompanied by a softening in the rate of manufacturing output decline. Services selector PMI in expansion with the figure at 51.1 points.

U.K. PMIs:

U.K. private sector output continues to rise at a solid pace in March, largely reflecting increasing business activity in the service economy. The Services PMI remains close to 53 points in expansion while the manufacturing PMI remains very close to 50 points, the level that separates expansion from contraction.

U.S. PMIs:

U.S. business activity continued to rise amid a marked upturn in manufacturing production. The manufacturing sector expanded by the most since mid-2022 as production and factory employment growth accelerated. Manufacturing output growth was the strongest since May 2022, driven by improving demand both at home and abroad. The PMI in manufacturing shows 52.5 points, even above the Services sector PMI figure. Both in expansion indicating the U.S. sustainable strong business conditions.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

Dollar Index (US_DX)

The release of higher-than-expected inflation figures the week before the USD started to gain strength moving higher and higher on a short-term upward trend since the Fed said that decisions in regard to cuts will be economic data dependent.

However, During the FOMC event last week on the 20th of March, the Fed announced that it decided to hold rates steady for now and avoided “delay” talks and strengthened expectations of a June rate cut. (Fedwatch tool showed over 70% probability of a cut in June compared with 55-60% seen before the release). In addition, economic projections for inflation: Fed Officials see 2.4% Inflation at the end of 2024, 2.2% at the end of 2025, and 2.0% at the end of 2026. The USD weakened significantly upon news release on the 20th of March, and DXY reversed from the upside. That changed when on the 21st of March the dollar started to gain strength again and appreciate against other currencies quite aggressively. It reversed back to the level before the FOMC event and moved upwards even beyond. Demand for the U.S. dollar seems to be quite strong at the moment as the SNB cut rates and the interest rate differential makes the dollar more attractive in the short term.

EURUSD

EURUSD

The pair moved opposite to the DXY path as the USD was the main driver. During the FOMC event, the dollar depreciated heavily causing the EURUSD to jump. After the event, on the 21st of March, the dollar experienced strong appreciation and the pair moved rapidly to the downside. The EURUSD fell due to the weak PMIs for the Eurozone as well causing its stronger fall as the EUR was weakening further due to the grim business data that were reported on the 21st March.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

CRYPTO MARKETS MONITOR

BTCUSD

Bitcoin suffered losses recently dropping from the peak at 74K, and continuing downwards until the FOMC event. After the news and during the press conference, Bitcoin saw a rise, returning back to the mean.

Since the 22nd of March, it actually experienced a good comeback with the price moving upwards crossing the 30-period MA on its way up and showing upward momentum. The 68K USD level is now an important resistance.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

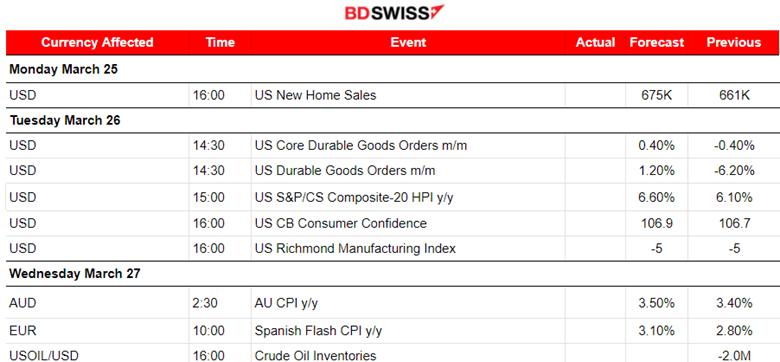

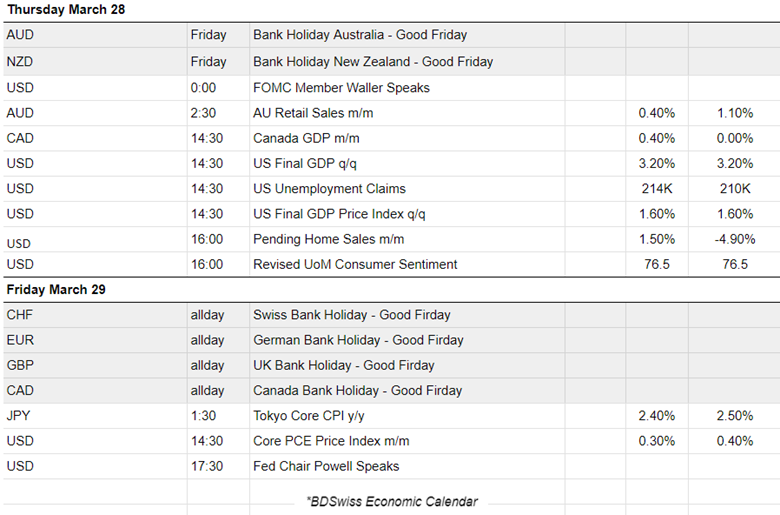

NEXT WEEK’S EVENTS (25 – 29.03.2024)

Coming up:

Bank Holiday: Good Friday

U.S. Core durable goods, CB Consumer Confidence, Inflation related news for Australia, Tokyo and the U.S.

Currency Markets Impact:

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

U.S. Crude Oil

Crude oil found a peak at 83 USD/b on the 19th of March and then retraced to near 80 USD/b following the FOMC. It could be the case that it moves above the MA and reaches the next resistance at 82 USD/b. The RSI currently supports a bullish divergence (higher lows) and the 30-period MA seems to turn sideways. Important support is near 80-82 USD/b.

Gold (XAUUSD)

Gold (XAUUSD)

FOMC: Powell decided yesterday to ignore the inflation data and their statements gave even a hint that rate cuts will proceed as expected. Gold Jumped near 65 USD as the USD depreciated heavily during the press conference. The dollar showed unusual strength after the FOMC event causing Gold to wipe out the gains since the FOMC news. Since the 21st March Gold moved below the 30-period MA and remained on a downtrend until today 25th March seemingly stabilising sideways as volatility levels lower.

_____________________________________________________________________________________________

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

On the 18th of March, the index moved rapidly upwards and then retraced again to the MA. On the 19th of March, it moved sideways as mentioned in our previous analysis. After the FOMC event, all U.S. indices saw a jump. The market’s initial expectation was that borrowing costs would lower soon or as expected this year, sparking this upward movement and resilience to the downside. Soon, however, expectations changed. The dollar saw massive strengthening and the U.S. indices started to drop since the 21st March. The Dow Jones fell rapidly from the 21st March’s peak near 40,000 down to 39,500 USD.

______________________________________________________________